If you see your customer support software vendor making headlines, you want it to be for a revolutionary new technology launch. But lately, customers of Zendesk have seen it in the news for all the wrong reasons. 2022 was a turbulent year for Zendesk. From being a publicly traded independent company, it was acquired by PE firms Permira and Hellman & Friedman for $10 billion. How will this affect Zendesk’s future and why should customers care?

Zendesk’s rocky journey from public to private

Co-founded in 2007, Zendesk was one of the first helpdesk SaaS solutions. Over the next seven years, the company accrued almost $85 million in funding before finally going public in 2014. While this arc is often seen as the ultimate blueprint for success for most tech companies, it was far from smooth sailing for Zendesk. In 2022, Zendesk’s stock price was down by 44%. The helpdesk solution tried to foray into the customer experience space by announcing its intention to acquire Momentive (the parent company of Survey Monkey) for $4 billion. The backlash that stemmed from the announcement, however, was huge. Activist investors, like Jana Partners, voted against the acquisition and forced Zendesk to drop the deal. After rejecting a $17 billion acquisition deal in February 2022, Zendesk finally had to settle for a $10 billion acquisition when the market shifted unfavorably.

How does going private change Zendesk's strategy?

Okay, so Zendesk’s ownership has changed hands and it’s not independent anymore. Does that really make a difference to its customers? The end product should remain the same regardless of ownership. On the face of it, things may seem that way. But PE firms have a fundamentally different set of priorities than an independent SaaS company does. Independent SaaS companies want to lead technology innovation. PE firms want to reduce costs. They raise funds from institutional investors and wealthy individuals, promising sizable returns. To generate these swift returns, acquired companies often resort to aggressive cost-cutting, even at the expense of product quality and customer service.

With $5 billion in leveraged debt loaded onto its books, Zendesk will be under intense pressure to service these loans through higher revenues and profits. Investments in R&D and evolving capabilities for customers will likely face deep cuts. Zendesk's new owners will be laser-focused on realizing quick returns, rather than enabling long-term product innovation. Private equity firms invest on a shorter timeline of 3-5 years. This requires acquired companies to demonstrate returns and growth quickly, often leading to short-term thinking and decisions. Innovation and R&D projects that take years to develop and mature may be deprioritized or cut altogether.

What does this mean for customers?

Zendesk going private may signal a shift in its commitment to delivering high quality customer service, potentially leading to reduced transparency and communication. Customers may experience uncertainty about future service levels, updates, and support quality.

The large debt obligations now saddled upon Zendesk will consume a significant chunk of its operating cash flow. The company will be under pressure to allocate capital towards servicing debt rather than investing in product or customer service. Moreover, the PE model incentivizes aggressive cost-cutting and headcount reduction to improve profit margins quickly. With an intense focus on the bottom line, customer service and product quality often suffer. Upgrades and new features may be delayed or scrapped if they don't positively impact revenues in the short term.

We’re already seeing indicators of Zendesk pulling back on customer service. Zendesk’s pricing comprises a complex list of add-ons that users will need to pay an additional cost for. Therefore, the total cost of using the tool often ends up being much higher than the quoted price. Any new customizations come at an added cost - if Zendesk even agrees to take up the request. Ironically for a customer support tool, the most recurring complaint customers have is Zendesk’s poor customer support. A quick scrape of their G2 reviews in the last year shows a number of users complaining about slow response times, poor support, and price gouging.

Here’s an excerpt from a LinkedIn post by a frustrated Zendesk customer who tried reaching Zendesk’s customer support for help modifying their licenses and pricing plan. Three months after first raising the request, they still have not received a response from Zendesk’s team.

Is it time to evaluate your support solution?

Zendesk's acquisition serves as a timely reminder to assess your solutions and partners. Don't let crucial investments in customer experience fall victim to external shareholders' fixation on short-term profits.

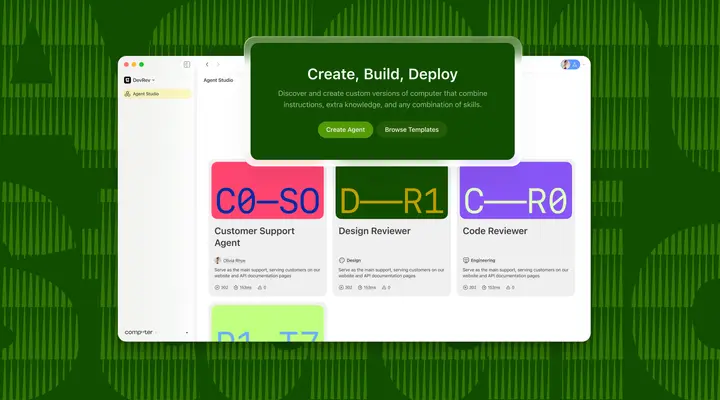

DevRev has been on a mission to transform enterprise customer support. Unlike Zendesk, DevRev is not just another ticketing tool. We enable support teams to collaborate closely with product and L3/L4 engineering teams, resolving complex problems faster and effectively closing the loop with end-users. With DevRev, support teams can relay critical customer feedback and become powerful collaborators to product development.

While Zendesk charts an uncertain path under new ownership, we remain committed to our customers' long-term success through the continued evolution of DevRev's platform.